- HOME

- Investor Relations

- Message from the President

Message from the President

December 2023 update

Q Please tell me about the performance for the first half of the year.

The performance for the first half of this fiscal year resulted in both sales and incomes falling below the planned figures. We deeply apologize for any inconvenience caused to our shareholders.

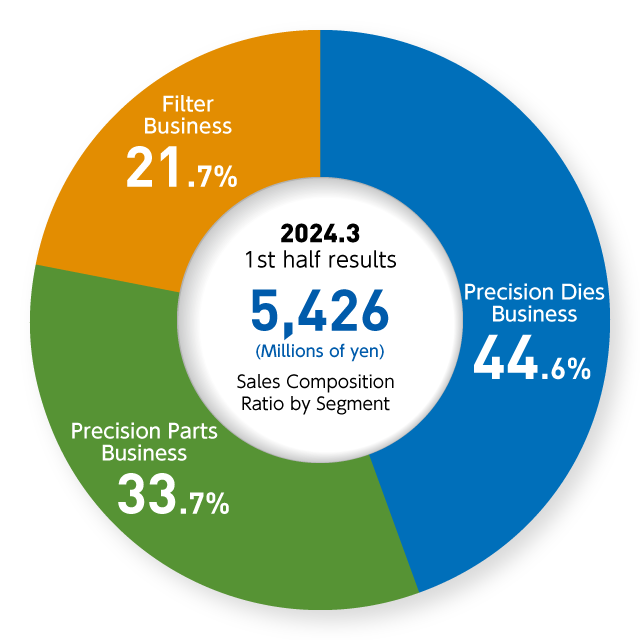

The disruptions in the supply chain, originating from the Ukraine crisis, are gradually settling down, and the production of automobiles in the key customer industries of our group is steadily recovering. Consequently, the sales of the Precision Die Business and Precision Parts Business have increased. However, factors such as the accelerated shift to electric vehicles (EVs) and slower-than-expected growth in the core business areas of our company, coupled with changes in product composition, have led to a decline in income margins. Additionally, the Filter Business experienced a decrease as demand in China, which was previously robust, subsided. Despite efforts to boost domestic sales to offset the decline, it resulted in a decrease in revenue and income compared to the previous year. As a result of these factors, the consolidated sales for the first half of the fiscal year ending March 2024 landed at 5,426 million yen (an increase of 3.4% compared to the same period last year). On the income side, the operating loss was 188 million yen (compared to an operating loss of 143 million yen in the same period last year), ordinary loss was 119 million yen (compared to an ordinary loss of 25 million yen in the same period last year), and the quarterly net loss attributable to the parent company's shareholders amounted to 168 million yen (compared to a quarterly net loss attributable to the parent company's shareholders of 151 million yen in the same period last year).

As we have emphasized before, the automotive industry is undergoing a structural transformation said to occur once in a century, with the acceleration of the shift towards carbon neutrality and electric vehicles (EVs). In response to this, our group has adopted the comprehensive mid-term management strategy "CHANGE ~NICHINOVATION 2026~" with a significant focus on creating new value through innovation. We have been implementing various measures to address these changes, including organizational restructuring and rebuilding our business portfolio. However, the pace and scale of changes in the business environment have exceeded expectations, necessitating more fundamental measures to adapt to the situation.

Q What are the recognized significant challenges?

Over the past few years, our group has faced a decrease in the quantity of automobiles due to the spread of the COVID-19 and semiconductor supply shortages. Additionally, we are currently compelled to address qualitative changes associated with the transition from traditional internal combustion engine vehicles to electric vehicles (EVs), alongside the quantitative challenges. The performance has been impacted by both of these factors. Based on the current recognition outlined in the table below, our group is addressing four significant challenges that require strategic and specific measures.

① Responding to the Transformation of the Automotive Industry

The turbocharger parts handled in the Precision Parts Business have been influenced by technological trends related to powertrain changes in recent years. Furthermore, in recent years, the wave of technological changes has also reached the core product of the Precision Die Business, which is precision forging dies. The automotive industry is focusing its resources on electric vehicles (EVs), leading to a slowdown in development in the internal combustion engine automotive sector. Leveraging our "development capabilities," we will respond to new demand related to EVs.

② Creation of new businesses

In the fiscal year 2021, we established a new business development department and are nurturing the buds of new businesses. In line with the transformative period of the automotive industry, we aim to create new businesses by fostering ideas that diversify customer industries.

③ Expansion into Overseas Markets

Due to the changing competition landscape driven by the transformation of the automotive industry and the resolution of the COVID-19 pandemic, the overseas strategy of our group is at a turning point. Acquiring demand from the Asian region, including Thailand and India, remains crucial. The Indian market, where we are focusing our efforts, presents challenges in aligning our strengths with the needs of our customers. As sustained growth is challenging in only the mature domestic market, we are reevaluating our strategy for a full-fledged overseas expansion.

④ Establishment of New Ways of Working

With the progress of information technology, there is a growing demand for more efficient business operations through the utilization of new digital services. However, our company places great importance on human collaboration in "manufacturing," which has led us to continue our initiatives with a traditional mindset. In the face of a decreasing workforce and labor shortages, there is a need for flexible responses, prompting us to incorporate more flexible thinking.

| Understanding of the Environment Before the COVID-19 Pandemic |

current understanding | |

|---|---|---|

|

|

|

|

|

|

|

|

|

Q What is the direction and current situation of our company?

Our company's management vision is the realization of a 3E company. One key point of this is the pursuit of "unrivaled technical expertise in creating products that other companies cannot replicate." However, the current situation involves strengthening existing businesses while exploring new avenues for growth, essentially navigating a transitional period. We aim to promptly identify promising future areas, implement "selection and focus," and connect it to growth in the coming fiscal year and beyond.

Our corporate group has adopted "CHANGE" as a slogan and has been implementing initiatives based on it. However, given the current business environment and the four important challenges mentioned earlier, we keenly feel the need to further raise awareness and actively address them. We are currently advancing initiatives with the keywords "new product development," "human resources," "global expansion," and "manufacturing reform," reinforcing management for a comprehensive "CHANGE."

- Keyword ① New Product Development

- We are focusing on exploring new domains based on core technologies such as precision forging and sintering techniques. Our aim is to achieve leadership in niche areas.

- Keyword ② Human Resources

- With the slogan ""Build a Company that Allows Employees to Shine"" we encourage bottom-up challenges to enhance employee motivation and improve productivity.

- Keyword ③ Global Expansion

- We are redefining the strengths of each location and implementing reforms in our global strategy. Collaborating with local subsidiaries, we aim to strengthen our competitiveness on a global scale.

- Keyword ④ Manufacturing Reform

- Anticipating a future decrease in the workforce, we are striving for streamlining and productivity improvement through the promotion of Digital Transformation (DX). Additionally, we are conscious of reducing CO2 emissions and promoting sustainability, reassessing traditional manufacturing practices in alignment with the changes of the times. Furthermore, we are enhancing the development of sensing technology in the current die sensing initiative and promoting the realization of forging DX.

Q How about the full-year outlook.

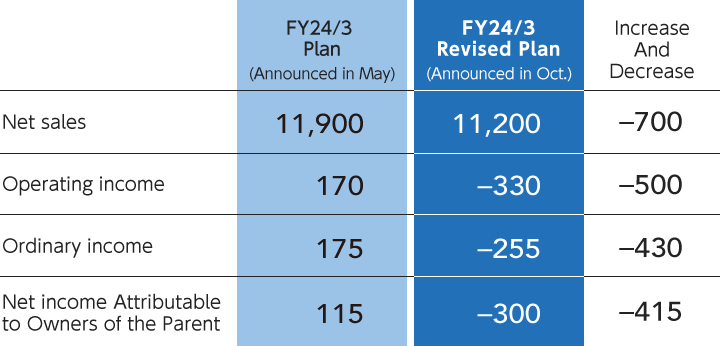

Due to a decrease in sales in the Filter Business and lower incomeability in the Precision Parts Business, we have decided to revise downward our performance forecast. In the Precision Die Business, it is anticipated that overseas sales will fall below the initial plan due to changes in the competitive environment.

While we expect supply chain disruptions to be limited and economic activities to progress, concerns arise about the impact of changing technological trends on performance. Given these circumstances, we anticipate consolidated full-year sales of 11,200 million yen, an operating loss of 330 million yen, an ordinary loss of 255 million yen, and a net loss attributable to the parent company of 300 million yen.

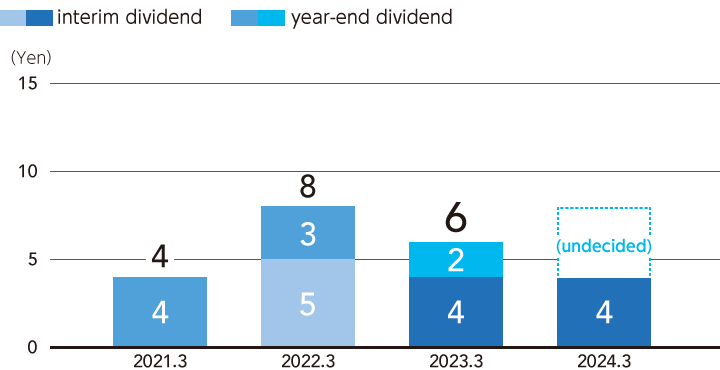

Q How about the year-end dividend.

Our company considers returning incomes to shareholders as a crucial policy and fundamental principle of management. While securing the necessary retained earnings for future business expansion and strengthening the financial foundation, we aim to continue stable dividends. For the current fiscal year's interim dividend, following this principle, we will maintain the initially projected 4 yen per share. However, the performance of the Filter Business and Precision Parts Business for the second half of the fiscal year is anticipated to fall below expectations, creating an uncertain outlook. Given these circumstances, the year-end dividend forecast is currently undecided. We plan to promptly disclose the decision as soon as it is made, taking into consideration the overall management environment and performance trends.

We sincerely appreciate the ongoing support from our shareholders.

FY 24/3 Full year outlook –Revision of Performance Forecast (October 31, 2023) –

(Millions of Yen)

* Rounded down to the nearest million yen

Dividend per share

Segment Overview

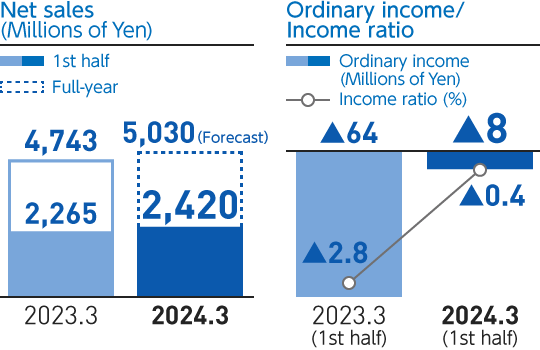

Precision Dies Business

* Rounded down to the nearest million yen

Overview of the First Half

Although overseas product sales fell below the plan, there was an increase in domestic product sales, leading to an overall trend of increased revenue compared to the same period last year. As a result, sales in the Precision Die Business reached 2,420 million yen (a 6.8% increase compared to the same period last year), and the ordinary loss amounted to 8 million yen (compared to an ordinary loss of 64 million yen in the same period last year).

Outlook for the Second Half

While the outlook for overseas product sales is uncertain, we anticipate a recovery in domestic demand. Therefore, the full-year sales forecast is set at 5,030 million yen, representing a 6.0% increase compared to the same period last year.

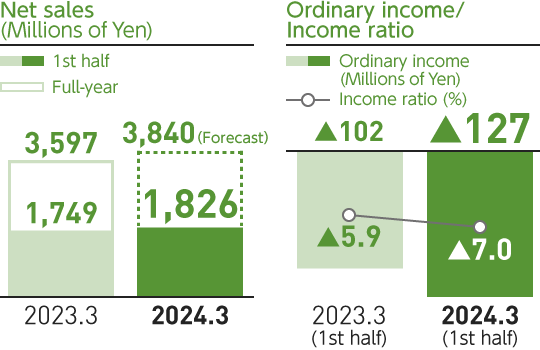

Precision Parts Business

* Rounded down to the nearest million yen

Overview of the First Half

Due to an increase in new parts, sales have increased compared to the previous year. However, due to changes in product composition, the income margin has deteriorated. As a result, sales in the Precision Parts Business reached 1,826 million yen (a 4.4% increase compared to the same period last year), and the ordinary loss amounted to 127 million yen (compared to an ordinary loss of 120 million yen in the same period last year).

Outlook for the Second Half

We anticipate an increase in demand for turbocharger parts, despite the precision forging products falling below the plan. Therefore, the full-year sales forecast is set at 3,840 million yen, representing a 6.8% increase compared to the same period last year.

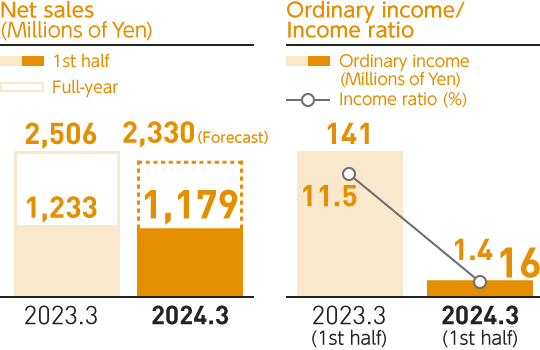

Filter Business

* Rounded down to the nearest million yen

Overview of the First Half

The strong demand for overseas products has weakened, leading to a decrease in sales compared to the previous year. Changes in product composition and a reduction in sales have also resulted in a decline in operating income. As a result, sales decreased by 4.3% to 11,790 million yen compared to the same period last year, and operating income decreased by 88.5% to 16 million yen compared to the same period last year.

Outlook for the Second Half

We will strengthen efforts to explore new demand, but given the uncertain economic situation in China, a key market, we anticipate that sales in the Filter Business will remain sluggish. Therefore, the full-year sales forecast is set at 2,330 million yen, representing a 7.0% decrease compared to the same period last year.