- HOME

- Investor Relations

- Message from the President

Message from the President

December 2024 update

We aim to achieve further growth by improving our profitability and implementing growth strategies.

Please tell me about the performance for the first half (interim period).

In addition to the continuing impact of the safety scandal in the Japanese automobile industry, which is the Group's main customer industry, the drop in demand in China and other countries around the world caused production by Japanese-affiliated finished vehicle manufacturers to remain sluggish both in Japan and overseas.

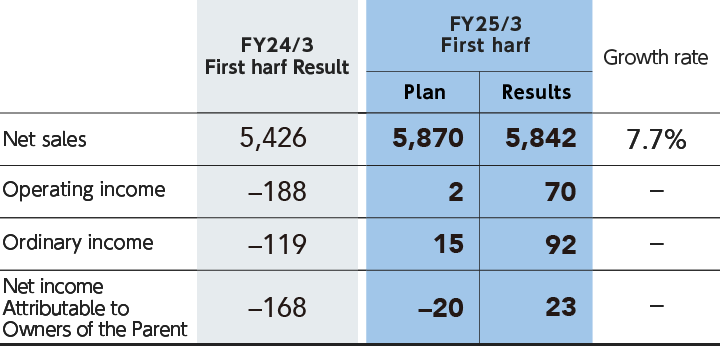

However, our group's sales remained roughly in line with the plan, and profits exceeded expectations. This was due to an increase in the composition ratio of highly profitable products and cost containment. As a result, consolidated sales for the first half of the fiscal year ending March 2025 were 5,842 million yen (up 7.7% year-on-year), and in terms of profit and loss, we recorded an operating profit of 70 million yen (operating loss of 188 million yen in the same period last year), an ordinary profit of 92 million yen (ordinary loss of 119 million yen in the same period last year), and net income attributable to owners of the parent of 23 million yen (interim net loss attributable to owners of the parent of 168 million yen in the same period last year).

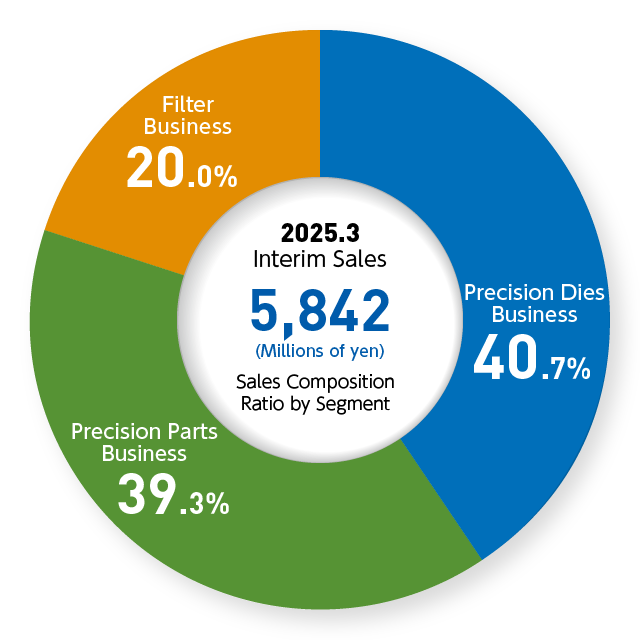

By business segment, sales in the precision dies business and the filter business remained at the same level as in the previous year, while sales in the precision parts business increased. In terms of profit and loss, recorded a profit from the previous year's loss due to an increase in profit from a change in the model mix in the filter business and a decrease in the loss in the precision parts business.

Results for the first half FY25/3(Millions of Yen)

Please tell me about the important issues to be addressed.

Nichidai has formulated a medium-term management strategy, “CHANGE - Nichinovation 2026,” and is working on various measures.

In the global automobile industry, the shift to BEV is slowing slightly, but is steadily progressing, and we recognize that responding to this change is an important issue. In response, we are promoting development for BEV.

Another important task is to expand into new fields and technological domains. As part of this effort, we are promoting the development of "Forged DX", which is being conducted by the New Business Planning Department.*

Furthermore, strengthening our global strategy is also an important issue, and we will promote efforts such as continuing to focus on the growing Indian market.

Finally, human resources are the driving force behind this medium-term management strategy, and we recognize that promoting the further growth of our employees is also an important issue. We are promoting human capital management while effectively utilizing internal and external resources.

- *

- Forging DX is a system that utilizes our company's know-how to integrate and visualize data in the forging field in real time.

Please tell me about the full-year outlook.

Nichidai's profit exceeded our forecast during the first half of the current fiscal year, the global economy remains uncertain due to the escalation of regional conflicts in Ukraine and the Middle East, the continued economic stagnation in China, and the expansion of protectionist policies. Considering these circumstances, we have decided to leave the consolidated earnings forecast announced at the beginning of the fiscal year unchanged.

Accordingly, for the full year, we expect consolidated net sales of 11,900 million yen (up 5.1% year-on-year), operating income of 80 million yen (vs. operating loss of 42 million yen in the same period last year), ordinary income of 100 million yen (up 54.0% year-on-year), and net income attributable to owners of the parent of 50 million yen (up 11.1% year-on-year).

Please tell me about the year-end dividend.

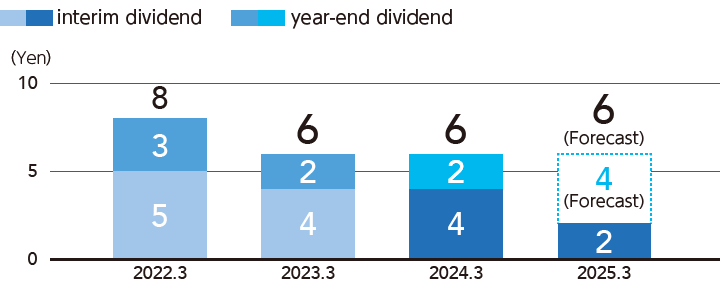

Nichidai regards the return of profits to shareholders as an important management policy and has a basic policy of maintaining stable dividends while securing the internal reserves necessary for future business development and strengthening the management structure. Based on this basic policy, Nichidai will pay an interim dividend of 2 yen per share for the current fiscal year, as forecasted at the beginning of this fiscal year.

The Company plans to pay a year-end dividend of 4 yen per share, for a total annual dividend of 6 yen per share.

We will continue to steadily implement strategies based on our medium-term management plan, including the creation of new businesses and investment in human resources, in order to enhance our corporate value over the medium to long term. We look forward to the continued support of our shareholders.

Dividend per share

Segment Overview

Precision Dies Business

* Rounded down to the nearest million yen

Overview of the first half of this fiscal year

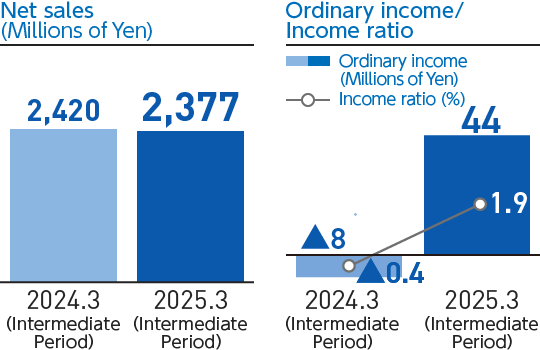

Overseas sales decreased in the Asian region, but domestic sales increased due to new demand. As a result, net sales totaled 2,377 million yen (down 1.8% year-on-year), and ordinary income was 44 million yen (compared with ordinary loss of 8 million yen in the same period of the previous year). Ordinary income was 44 million yen (ordinary loss of 8 million yen in the same period of the previous year).

Forecast for the second half of this fiscal year

While sales of products for overseas markets are sluggish, we expect the same level of sales as in the first half of the fiscal year.

Precision Parts Business

* Rounded down to the nearest million yen

Overview of the first half of this fiscal year

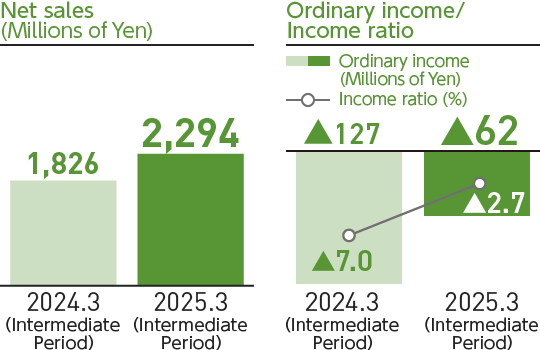

Sales of turbocharger parts increased at both domestic and overseas bases. As a result, net sales amounted to 2,294 million yen (up 25.6% year-on-year).

Forecast for the second half of this fiscal year

Sales are expected to be the same as in the first half of the year.

Filter Business

* Rounded down to the nearest million yen

Overview of the first half of this fiscal year

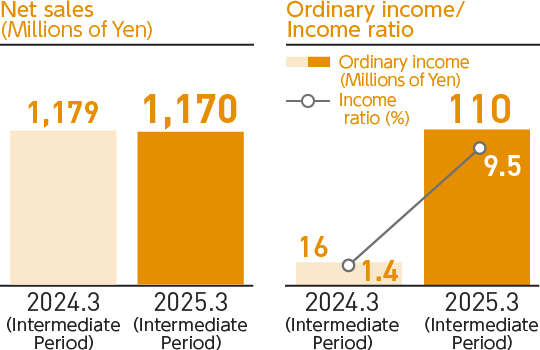

Sales remained at the same level as the previous year as overseas sales recovered from the previous year's slump, despite a decrease in domestic sales. As a result, net sales were 1,170 million yen (down 0.8% year-on-year) and ordinary income was 110 million yen (up 577.0% year-on-year).

Forecast for the second half of this fiscal year

We expect sales to remain strong and are forecasting the same level of sales as in the first half of the year.